How Much Does Dental School Cost? My Simple Guide for 2024-2025

Table of Contents

- Introduction: Why Dental School’s Price Tag Matters More Than You Think

- The Real Cost of Dental School: My First-Hand Overview

- Understanding “Cost of Attendance” (COA)

- Breaking Down the Main Expenses: Where the Money Goes

- Tuition and Academic Fees

- Living Expenses: What Life Really Costs

- Books, Supplies, and Instruments

- Health Insurance

- Pre-Admission and Application Costs

- What Changes What You’ll Pay? Five Key Cost Factors

- How I Paid (and How You Can Too): Loans, Scholarships, and Other Options

- Federal Loans: The Foundation for Most

- Scholarships and Grants

- Private Loans and Other Paths

- Is Dental School Worth the Investment? My Honest Take

- Understanding ROI in Dentistry

- Paying Back Student Loans: Strategies That Work

- Smart Strategies to Lower Your Debt: My Hard-Won Tips

- Closing Thoughts: What I Wish I’d Known Before Starting

Introduction: Why Dental School’s Price Tag Matters More Than You Think

When I was first looking at being a dentist, I asked myself the main question: How much does dental school cost? I wanted real numbers—not just a rough tuition, but a clear look at every single thing I’d have to pay, from starting applications to that last textbook and drill. Picking a dental school isn’t only about your dreams. It’s also one of the biggest money choices you’ll ever make.

In this guide, I’ll show you what it really costs, all the little and “surprise” costs, the debts students often get, and the best ways to pay for your dream, all from what I picked up along the way.

The Real Cost of Dental School: My First-Hand Overview

To be honest: dental school costs a lot. Most people hear about big tuition, but that’s only one part of the story.

Understanding “Cost of Attendance” (COA)

Dental schools figure out something called the Cost of Attendance, or COA. Think of it like a full bill for each year of dental school. COA has:

- Tuition

- Required school fees

- Living costs (housing, food, getting around, bills)

- Books and class supplies

- Dental tools

- Health insurance

- Personal spending

Here’s what I found when I looked into it for 2023–2024:

| Expense Category | Public (In-State) | Public (Out-Of-State) | Private |

|---|---|---|---|

| Tuition | $35k–$60k | $60k–$90k | $70k–$100k+ |

| Fees | $5k–$15k | $5k–$15k | $5k–$20k |

| Living Expenses | $20k–$35k | $20k–$35k | $20k–$35k |

| Books & Supplies | $1.5k–$3k | $1.5k–$3k | $1.5k–$3k |

| Dental Equipment | $5k–$15k | $5k–$15k | $5k–$15k |

| Health Insurance | $2k–$5k | $2k–$5k | $2k–$5k |

| Transportation | $1k–$3k | $1k–$3k | $1k–$3k |

| Personal Expenses | $2k–$4k | $2k–$4k | $2k–$4k |

| Total ANNUAL COA | $71.5k–$140k | $99.5k–$180k | $109.5k–$195k+ |

Multiply that by four (most dental degrees take four years) and you see how the total can be $300,000–$400,000+—sometimes it’s even more.

Breaking Down the Main Expenses: Where the Money Goes

Let’s look at every area of what dental school really costs, starting with what hit my budget the most and what can surprise new students.

Tuition and Academic Fees

Public vs. Private: The First Big Difference

When I first started, I thought all dental schools cost the same. Nope. Public schools are almost always much cheaper than private schools, especially if you pay in-state.

- In-State Tuition (Public): I saw from $35,000 to $60,000 each year.

- Out-of-State Tuition (Public): This shoots up to $60,000–$90,000.

- Private Schools: Usually start at over $70,000, with some well-known names even going over $100,000 a year.

Required Fees

My first year, “required fees” looked like a mess of random costs: tech fees, lab fees, health fees, and more. You have to pay them, and at some schools, they can be over $15,000 a year.

Living Expenses: What Life Really Costs

The top thing my friends and I worried about: How can I stop rent and food from emptying my bank account?

- Housing: On-campus is often higher but simple; off-campus can be better if you split with roommates.

- Food and Groceries: School meal plans are easy, but if you cook at home, you’ll save a lot (if you can find the time).

- Bills and Internet: Don’t forget about these—especially in big cities, bills get expensive.

- Getting Around: Driving (gas, parking, keeping your car running) or public transport can both add up, depending on the city.

- Personal Stuff: Everyone thinks they’ll spend less here. Overplan—something always pops up.

After living in a pricey city, I learned to check every budget line. Some students lived on under $20,000 a year; others didn’t realize they were spending $35,000 or more.

Books, Supplies, and Instruments

Textbooks & Online Stuff

The cost of books in my first year shocked me. With all the books and websites I had to pay for, I spent close to $3,000. I later found out you can buy used or share—highly recommend this!

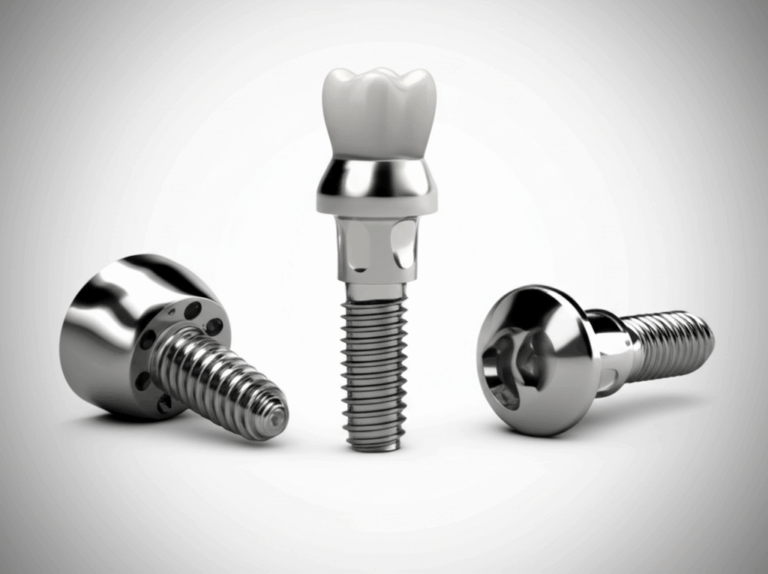

Tools and Instruments

A surprise—all the gear you have to buy. One school made us get our own kits, and I paid almost $10,000 up front. Some programs let you rent or get part of the kit from school.

Tip: Interested in new tech? Take a look at how digital dental labs are changing things for students and dentists.

Health Insurance

Almost every dental school says you have to have health insurance. If you’re not still on your parents’ or a partner’s plan, the school plan is often required—mine was about $3,200 each year.

Pre-Admission and Application Costs

You’ll start paying before you ever walk into class:

- DAT Exam: $495 last I checked.

- Application Fees (ADEA AADSAS): $264 for your first school, $116 for each extra one. If, like me, you apply to 10 schools, you’ll spend over $1,300.

- Travel and Interviews: This can get wild. Flying to schools, hotels, eating out—my total was a few thousand dollars.

What Changes What You’ll Pay? Five Key Cost Factors

Not everyone pays the same. Here’s what made the most difference for me and my friends:

How I Paid (and How You Can Too): Loans, Scholarships, and Other Options

Honestly, most of us use a mix of loans, scholarships, and smart planning to make it through dental school.

Federal Loans: The Main Way for Most

For me—and just about every other dentist I know—federal student loans were the main thing:

- Direct Unsubsidized Loans: Usually the first choice, but don’t cover it all.

- Graduate PLUS Loans: What I turned to when the first kind ran out.

- FAFSA: A must. I filled it out every year—even if you don’t think you’ll get much, just do it.

But: these loans grow interest fast. After four years, I owed close to $300,000. Most classmates were the same. The American Dental Education Association says this is pretty normal now.

Scholarships and Grants

Did scholarships help? Yes. Did they cover everything? Not even close, but every bit helps!

- School Scholarships: Some universities give money to dental students with good grades, leadership, or community work.

- Professional Groups: Places like the American Dental Association or state dental groups have scholarships. These are tough to get, but worth a try.

- Service Programs: Programs like the National Health Service Corps (NHSC) and the military’s Health Professions Scholarship can pay your way—if you don’t mind working where they send you after. Some friends loved the adventure here.

Private Loans and Other Ideas

Sometimes federal loans weren’t enough, especially for friends at super expensive schools. Some got private loans. Just remember, these come with higher interest and need a cosigner.

Some other ways I saw:

- Family help or savings: Not common, but if you have it, use it.

- Part-time work: Possible, but school is tough and I wouldn’t suggest working more than a few hours a week.

Is Dental School Worth the Investment? My Honest Take

Here’s the big thing. Spending $300,000–$500,000 (or more) is frightening. I kept asking myself, “Can I ever pay this back? Is this worth it?” Here’s what I saw for myself and my friends.

Understanding ROI in Dentistry

Let’s put some numbers here:

- New General Dentist: You’ll probably start with $120,000–$180,000 a year.

- Specialists (like Orthodontists, Oral Surgeons): Starting salaries at $250,000+, sometimes $400,000+ as you get more experience.

Of course, this changes with where you live and the kind of dentistry job you pick.

Real-World Example

A friend of mine went to a public, in-state school, owed about $260,000, lived with roommates, cooked at home, got a small scholarship, and works in a regular-sized city. By staying careful with money and picking a special loan plan, he thinks he’ll be debt free in 15–20 years.

Another friend picked an out-of-state, private school and borrowed even more: $450,000. She also did extra training that cost even more. But now, as an oral surgeon, her bigger paycheck helps her pay those loans—though the debt still makes her think twice about where to work or buy a house.

Paying Back Student Loans: What Helped Me

After graduation, time to pay. Here’s what I did—and what I wish I knew before:

- Income-Driven Repayment (IDR): This was my safety net. The payment depends on what you make, not how much you owe.

- Public Service Loan Forgiveness (PSLF): If you work in the right nonprofit or public jobs, your loans can be forgiven after 10 years.

- Refinancing: Some friends got lower interest rates, but watch out—you might lose some federal loan benefits.

- Pay More Early: If you can live simply for a few more years, throw every dollar you can at the loans.

Smart Strategies to Lower Your Debt: My Hard-Won Tips

After four tough years, here are the tricks I figured out (most the hard way):

And about tools: I learned about how technology is changing dentistry and that helped me. Stuff like dental ceramics labs and even 3D printers can save money or avoid surprises.

Big tip: Always talk to your school’s money office. They might know programs you’ve never heard of.

Closing Thoughts: What I Wish I’d Known Before Starting

If I could give myself advice before dental school, it would be:

- Look at the real costs. Don’t just ask about tuition. Think about everything—the application costs, living expenses, tools, and insurance.

- Plan for loans or scholarships early. Deadlines come fast, and missing them hurts.

- Ask students who are already there. What they say is usually more useful than what you find on a website.

- Don’t just go by a famous name. Sometimes the cheaper school will give you the same degree and job—without all the extra debt.

- Your money health is just as important as your grades. Stress from loans can make you not enjoy helping patients.

Dental school is tough, but if you plan it right, have some discipline, and get some help, you’ll make it out ready for a bright future.

And if you ever want to see what technology and labs you might use, check out a china dental lab or learn how a crown and bridge dental lab makes things happen. You never know—maybe you’ll work with the next big breakthrough after you graduate.

Got more questions or need help about the costs of dental school? Leave a comment below—I’ve gone through it, and I’m happy to help future dentists figure it out, one step at a time.