Are Dental Implants Covered by MetLife Insurance? (The Definitive Guide)

Table of Contents

- My Journey With Dental Implants and MetLife Insurance

- Understanding MetLife’s Stance on Dental Implant Coverage

- Key Factors Influencing MetLife Dental Implant Coverage

- Your Specific MetLife Dental Plan Type

- Annual Maximums and Deductibles

- Coinsurance Percentages for Major Services

- Waiting Periods for Major Restorative Procedures

- Pre-Authorization Requirements

- Medical Necessity Documentation

- Covered Components of the Implant Procedure

- How I Confirmed My MetLife Dental Implant Coverage

- Maximizing Your MetLife Dental Implant Benefits

- What If MetLife Coverage Is Insufficient? (Alternative Payment & Treatment Options)

- Frequently Asked Questions (FAQs) About MetLife & Dental Implants

- Final Thoughts: Navigating MetLife Coverage for Dental Implants

My Journey With Dental Implants and MetLife Insurance

Let me tell you about the day my dentist first said the word “implant.” I’d lost a tooth and suddenly, I had to worry about cost, what insurance would pay, and what would happen to my smile. I thought having MetLife dental insurance would make everything simple, but I quickly realized it’s not always that easy.

In this guide, I’ll share what I learned—how MetLife looks at dental implants, what steps I had to go through, and mistakes I wish I hadn’t made. If you want to know if MetLife pays for dental implants, how much they cover, or how much money you might have to pay, you’re in the right place. This is the guide I wish I’d found before I started.

Understanding MetLife’s Stance on Dental Implant Coverage

When I started looking at my insurance policy, I thought the answer to “Are dental implants covered by MetLife?” would be clear. It’s not.

MetLife puts dental implants in their “major restorative” services. So, they don’t count as regular cleanings or small fixes like fillings. Implants are in the same group as crowns, bridges, and root canals.

Are they always covered? No. Whether MetLife helps pay for your implant depends on a few things. They check if you really need the implant (like when you lost a tooth from an accident) or if it’s just to look better (like fixing a gap you don’t like). If you really need it, you have a better chance of getting help from insurance. If it’s mostly just for looks, you probably won’t.

Confused? I was too. But once I saw that MetLife does mostly what other insurance companies do, the rules made more sense.

Key Factors Influencing MetLife Dental Implant Coverage

If you only remember one thing, it’s this: What MetLife covers can change a lot based on your plan. Here’s what mattered most for me (and probably for you too).

Your Specific MetLife Dental Plan Type

Not all MetLife dental plans are the same. When I first called, the customer service rep quickly asked what kind of plan I had. Here’s what I found:

- PPO (Preferred Provider Organization): PPO plans usually cover more and let you pick from more dentists. My plan let me get an implant as a big dental repair, but there was still a limit.

- HMO (Health Maintenance Organization): HMOs usually cost less every month but can limit choices and may not cover implants at all.

- Federal Employee Dental Plans (FEHBP): These are a lot like PPOs but have their own rules, like different maximum amounts and a few things they don’t cover.

- Employer-sponsored vs. Individual: My plan through work gave me more benefits than the individual plan my friend had. Always check how your plan treats big dental repairs and look at the summary of benefits.

If you’re wondering how dental labs play a part in your care, special labs—like a china dental lab—might affect the work you get, but your insurance mostly just cares about your plan and which dentists they work with.

Annual Maximums and Deductibles

Even if your plan helps with implants, there’s often a catch—the yearly maximum. MetLife, and most other insurers, only pay up to a set amount each year. My plan would pay up to $2,000 a year. But a single implant (plus the piece on top) can cost even more.

What happened to me: My own costs got high fast once I hit that yearly maximum. I also had to pay my deductible (often $50 to $150) before MetLife paid anything.

Coinsurance Percentages for Major Services

Coinsurance is insurance-speak for what you pay versus what MetLife pays, after the deductible is paid. For major services like implants, my plan was a 50/50 split.

Here’s what that means: If the whole implant procedure costs $4,000 after the deductible, MetLife pays $2,000. But if your plan pays a max of $2,000 a year, you still owe the rest.

Waiting Periods for Major Restorative Procedures

Waiting takes patience, and with dental insurance, sometimes you have to wait. MetLife made me wait 12 months before doing “major restorative” work. So if you just signed up or just got new insurance, you might have to wait to start your treatment.

Pre-Authorization Requirements

This step is super important. Before I booked my surgery, my dentist had to send in paperwork for approval by MetLife. This told us up front what they’d pay and what I’d have to cover. If you skip this, you might get a big surprise bill.

Think of pre-authorization as a green light from MetLife. They’ll check your dentist’s treatment idea, decide if it’s really needed, and give you a paper with the costs. For me, this paperwork stopped a lot of headaches later.

Medical Necessity Documentation

If something is just for looks, MetLife usually says no. My dentist had to show proof that I really needed the implant. That meant x-rays, a letter about my problem, and a note about why chewing was hard for me. More paperwork always helped.

If you lost a tooth from an accident or a bad infection, you’ll probably have an easier time getting approved than if you just want to replace an old bridge for no big reason.

Covered Components of the Implant Procedure

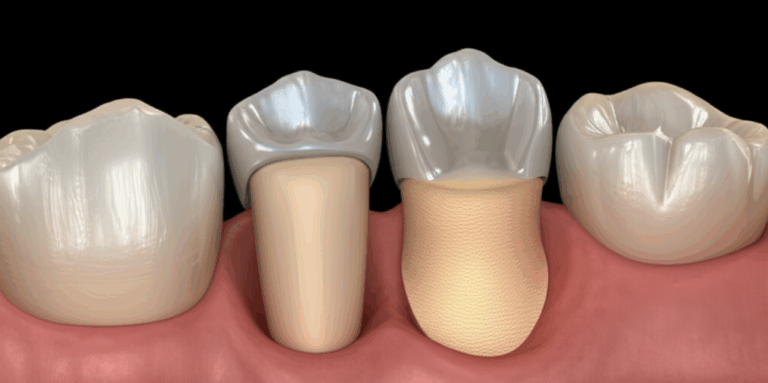

Implants have different parts. There’s the post (the implant), the connector (abutment), the tooth cap (crown), and sometimes bone repairs or tooth pulling. MetLife breaks these down:

- Implant Post: Sometimes covered as a major repair service.

- Abutment and Crown: Usually covered, but percentages may change.

- Bone Repair and Tooth Pulling: Sometimes these are covered under basic oral surgery, sometimes at a better rate.

From what I learned, always ask about every part. Don’t guess.

How I Confirmed My MetLife Dental Implant Coverage

Honestly, it was pretty hard finding out exactly what my plan covered. Here’s how I figured it out:

Even if your dentist uses a great implant dental laboratory, MetLife really just cares about the codes and what your plan says is okay—not the brand or lab.

Maximizing Your MetLife Dental Implant Benefits

After I figured out my coverage, I wanted to make sure I got as much help as possible. Here’s what helped me:

- Pick In-Network Dentists: MetLife pays a higher percent when you use their network. Going out-of-network almost cost me a lot more.

- Buy Time With Your Treatment: My dentist helped me do one implant in December (using what was left of my yearly max), then the rest in January (when my benefits reset). So MetLife paid more overall.

- Use FSAs and HSAs: My job gave me a Flexible Spending Account (FSA), so I could pay some of my costs with money not taxed. Health Savings Accounts (HSA) do the same thing.

- Appeal Denials: The first time, my claim was denied because I didn’t have enough paperwork. I didn’t stop there. I sent in more proof. Many appeals are approved if you have good papers, and it worked for me.

If you want to see how new digital tools and materials can help dentists (and sometimes make it cheaper), you can check out what a digital dental lab does.

What If MetLife Coverage Is Insufficient? (Alternative Payment & Treatment Options)

MetLife doesn’t always cover the whole bill. Here’s how I closed the gap:

- Dental Payment Plans: Many dentists use companies like CareCredit to let you pay over time, if you qualify.

- Split Payments With The Office: You can sometimes ask your dental office to let you pay a little each month.

- Dental Schools: Clinics at dental schools might give big discounts for work done by students (supervised by dentists).

- Other Options: Before I went ahead with implants, my dentist told me about cheaper ways like bridges or partial dentures—because insurance may cover more of those.

If you want to compare crowns and bridges with implants, it helps to know your options—especially if insurance doesn’t pay much.

Frequently Asked Questions (FAQs) About MetLife & Dental Implants

Does MetLife cover bone repair for implants?

Sometimes they do, if it’s really needed and part of the implant process. Ask for an okay from MetLife first and check the policy.

Is there a separate deductible for big services?

Usually, you have just one yearly deductible (like $50–$150) for all types of care. Once that’s paid, MetLife starts helping with your other dental work.

How long does it take MetLife to process a claim for an implant?

For me, it took from 2 to 6 weeks, and it went faster when all the paperwork was sent with the claim.

Can I get implants if I had a problem before I got insurance?

This can be hard. If your tooth was already missing when your insurance started (or before your waiting period ended), MetLife might not pay for it. Always double-check the dates.

Final Thoughts: Navigating MetLife Coverage for Dental Implants

Dealing with insurance can feel really tough. When I started, I just wanted a new tooth. What I got was a crash course in forms, rules, and waiting.

Here’s what I wish I knew at the start: Learn the details of your plan. Always get pre-authorization. Keep your papers. Don’t be afraid to ask questions, fight a denial, or look for payment plans.

Most of all—remember you’re not alone. I had days I wanted to quit, but sticking with it paid off. Insurance doesn’t usually cover everything, but if you plan right, you can save money.

I hope what I learned saves you time, money, and stress. If you’re starting this process, don’t give up. You—and your smile—are worth it.